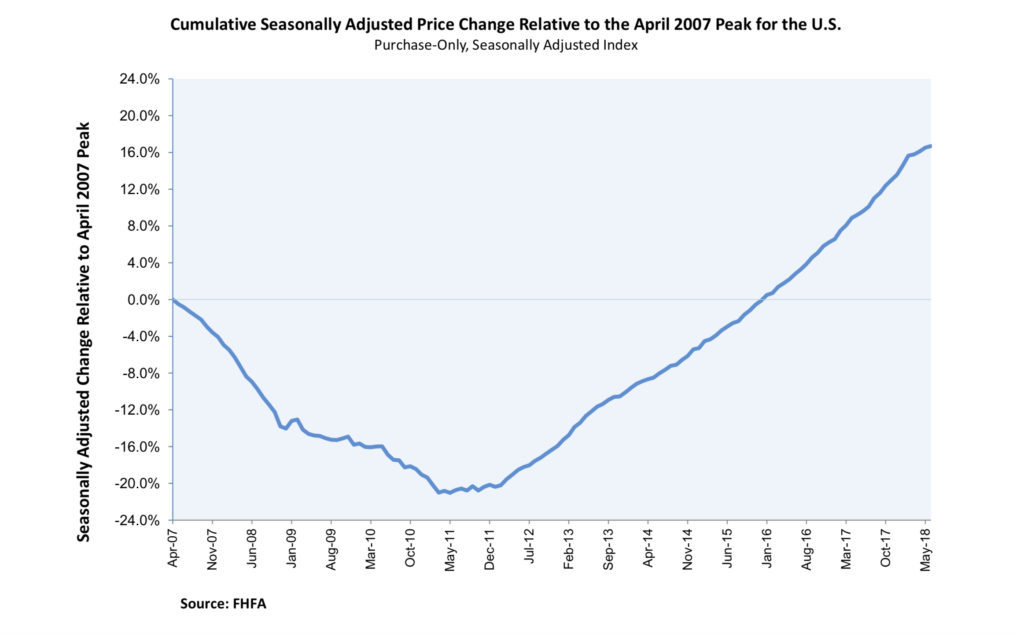

U.S. home prices rose 6.5 percent year-over-year in the second quarter of 2018, according to the latest Federal Housing Finance Agency (FHFA) House Price Index (HPI). Home prices were were up 1.1 percent over the first quarter of 2018.

“Home prices rose in the second quarter but at a slower pace than we have seen for the past four years,” said Dr. William Doerner, supervisory economist at FHFA. “Mortgage rates have increased by more than half a percentage point over the first six months of this year. Rates are still inexpensive from a historical standpoint, but their bump-up appears to have gently pressed the brakes on house price increases.”

Prices rose in all 50 states and the District of Columbia with Nevada seeing the highest growth at 17 percent, year-over-year. Alaska saw the slowest growth, with home prices rising only 2.6 percent over that same period.

Prices rose in all 50 states and the District of Columbia with Nevada seeing the highest growth at 17 percent, year-over-year. Alaska saw the slowest growth, with home prices rising only 2.6 percent over that same period.

Home prices also rose in 99 out of 100 of the largest metropolitan areas in the country. The largest annual appreciation took place in Las Vegas Nevada, where prices jumped by 18.8 percent. El Paso, Texas, was the only major metro to see prices depreciate, falling 0.03 percent, year-over-year.

The FHFA calculates HPI by using home sales price information from mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac.

Don’t wait for another downturn: recession-proof your business today

Tom Ferry’s tips to dominate – even in a changing marketplace READ MORE

Don’t wait for another downturn: recession-proof your business today

Tom Ferry’s tips to dominate – even in a changing marketplace READ MORE

Source: click here