Home prices are still growing, but signs of a slowdown are on the horizon, according to a CoreLogic Home Price Index and Forecast released Tuesday.

In September, home prices rose 5.6 percent year-over-year and 0.4 percent from August, according to the analysis. The average price of a single-family home now stands at $285,700, according to some estimates.

Coupled with inventory shortages and high demand, such numbers mark a nationwide trend — home prices have been creeping steadily upward since 2012. However, according to CoreLogic, home prices will only increase by 4.7 percent between now and September 2019.

While in the past many states have seen home values grow by more than 10 percent in a month, only Texas and Nevada saw such double-digit growth (12.8 percent and 11.9 percent, respectively) this September.

Courtesy of CoreLogic

Increasing unaffordability is a key reason for the slowdown. Competition for homes, particularly affordable starter homes, is high. In some cases, low-end homes across the country sell for more than $100,000 more than their asking price.

Solving the largest crisis for agents: healthcare

It’s time for all real estate professionals to have peace of mind READ MORE

Solving the largest crisis for agents: healthcare

It’s time for all real estate professionals to have peace of mind READ MORE

As a result, many renters who would otherwise be looking to own are instead holding off and waiting to see if the market shifts in their favor.

“The erosion of affordability in the highest cost markets has begun to slow home price growth,” said Dr. Frank Nothaft, chief economist for CoreLogic, in a prepared statement. “Hawaii, California and Massachusetts had median sales prices above $400,000 this summer, the highest in the nation, while annual home price growth slowed steadily between June and September in these three states.”

Courtesy of CoreLogic

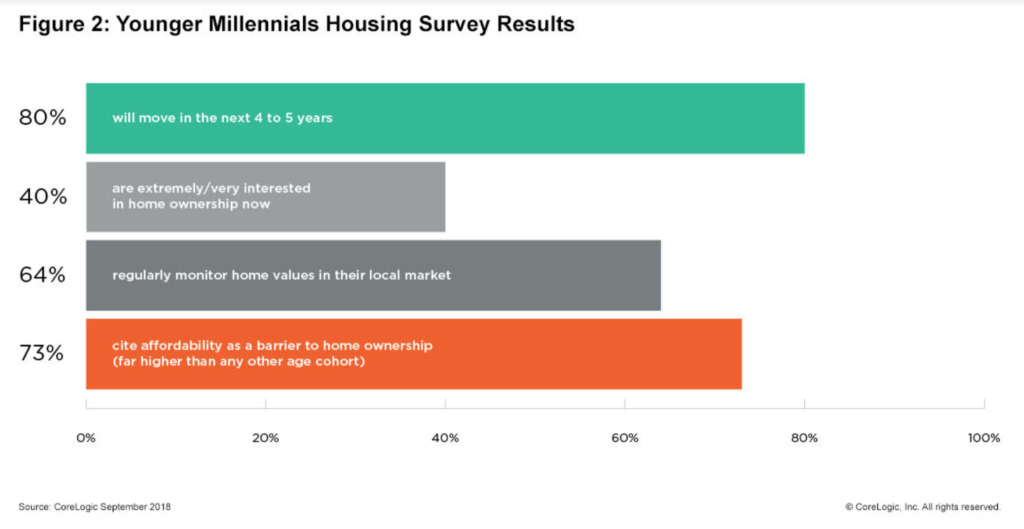

Even with an increasingly unaffordable market, many hope to buy a home. According to CoreLogic, 40 percent of millennials are “extremely” or “very interested” in owning a home while 64 percent regularly monitor home values in their local market.

“Our consumer research indicates younger millennials want to purchase homes but the majority of them consider affordability a key obstacle,” said Frank Martell, president and CEO of CoreLogic. “Less than half of younger millennials who are currently renting feel confident they will qualify for a mortgage, especially in such a competitive environment.”

Source: click here