Immigrants to the U.S. who buy homes aren’t deterred by the high prices of major metropolitan areas, according to a recent analysis by online lending marketplace LendingTree.

The analysis found that cities like San Francisco, Los Angeles and San Jose host some of the county’s largest immigrant home ownerships rates at 17.9, 18.3 and 24.8 percent, respectively. Those locations also had some of the highest home prices, with median home prices in San Francisco and San Jose almost hitting a figure of a million dollars ($849,000, and $947,700).

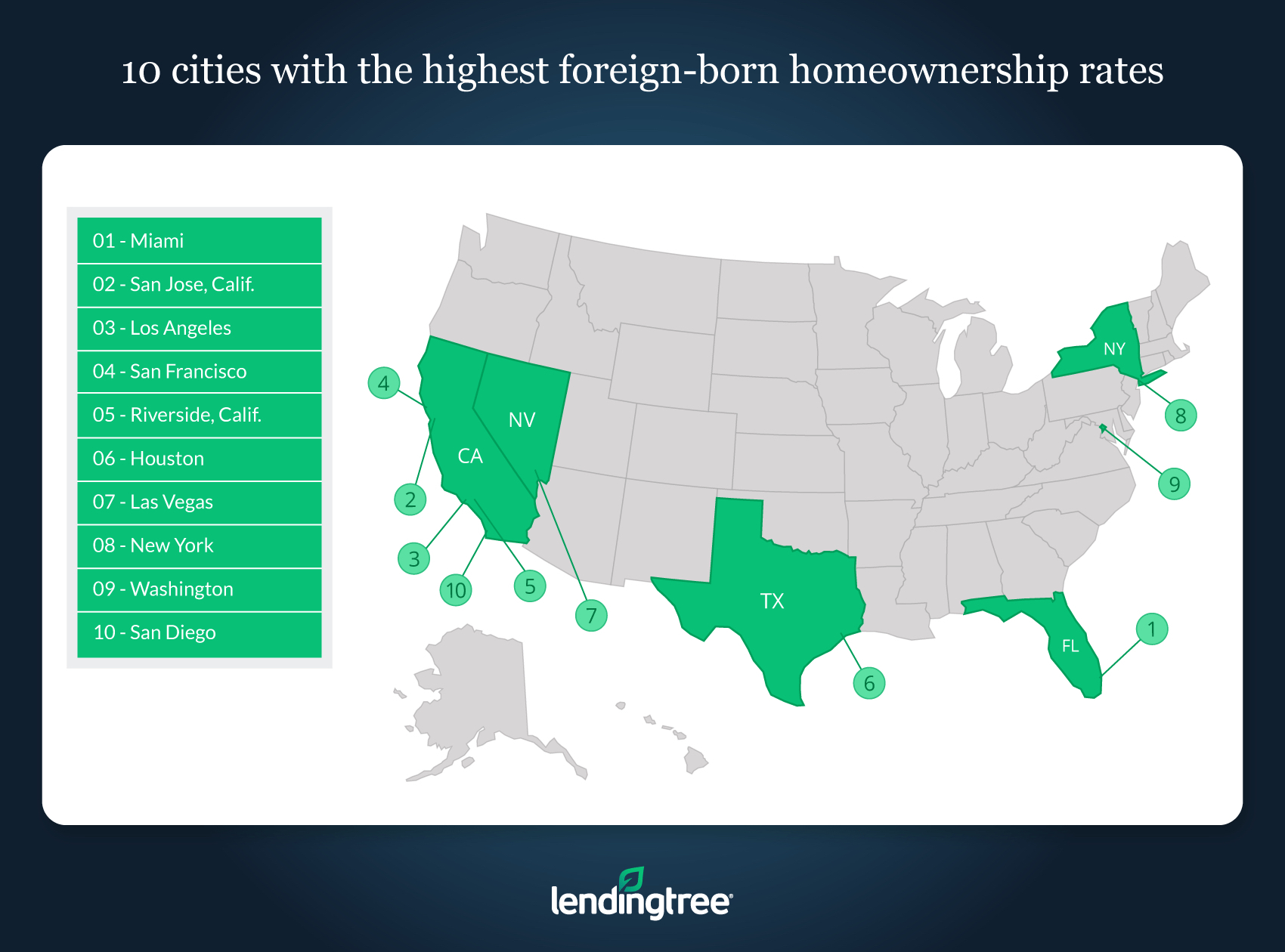

Credit: LendingTree

Indeed, when LendingTree looked at the 50 largest cities in the country, cities with a larger percentage of foreign-born homeowners also had higher home prices. As LendingTree chief economist Tendayi Kapfidze wrote in a blog post, “home prices and foreign-born homeownership rates are highly correlated.”

LendingTree does not postulate that house prices were driven by an influx of immigrants to these cities, instead that newcomers to the U.S. are attracted to “the most dynamic urban centers,” it wrote.

New arrivals buying homes in the U.S. seem to also prefer coastal cities with the previously mentioned locations and Riverside, CA among the top five in the immigrant home ownership.

Ready player one: how the new hybrid virtual brokerage can help you compete

Brick and mortar brokerages can add virtual capabilities with a hybrid business model READ MORE

Ready player one: how the new hybrid virtual brokerage can help you compete

Brick and mortar brokerages can add virtual capabilities with a hybrid business model READ MORE

Interestingly, one outlier was the city with the highest amount of immigrant homeowners at 25.7 percent: Miami. it came in at a more attainable median home price of $278,700. That’s close to the overall median home price of $276,000, the National Association of Realtors revealed in July.

LendingTree also referenced a report on immigration produced by Oxford University and Citi Research, part of the financial services firm Citigroup, which found that removing immigrant communities from the equation could have some drastic economic effects.

“The study estimated that economic growth from 2011 to 2016 would have been much lower without the impact of immigrants and that most of the post-crisis gains in the economy would have been eliminated,” Kapfidze wrote.

Earlier this year, a survey from Redfin sought to understand how immigration policies had influenced the home buying decisions in the U.S.

According to the results, 15 percent of respondents sold their home or did not buy a home because of restrictive immigration policies. Eight percent said they sold their home because they were worried they wouldn’t be able to work or stay in the U.S. much longer, and seven percent of would-be buyers said the same. Another 18 percent said they “considered” not buying or selling for the same reasons.

LendingTree used data from the Census Bureau’s American Community Survey on Sept. 20 to reach the conclusions found in its report.

Source: click here