Today marks the debut of Lower.com, a Columbus, Ohio-based startup specializing in smart mortgage lending.

According to the company, which is named for its lower loan rates (currently as low as 4.375 percent on a 30-year-fixed mortgage for $200,000), Lower.com “is the first to compare thousands of data points and past loans to give borrowers a personalized loan recommendation,” that is, what type of loan they should get for their particular home and financial situation.

Dan Synder, Lower Founder and CEO. Credit: Lower

Lower says borrowers can complete their entirely digital application online in as few as 5 to 10 minutes. The company also charges a variety of fees to borrowers, which is how it makes its money.

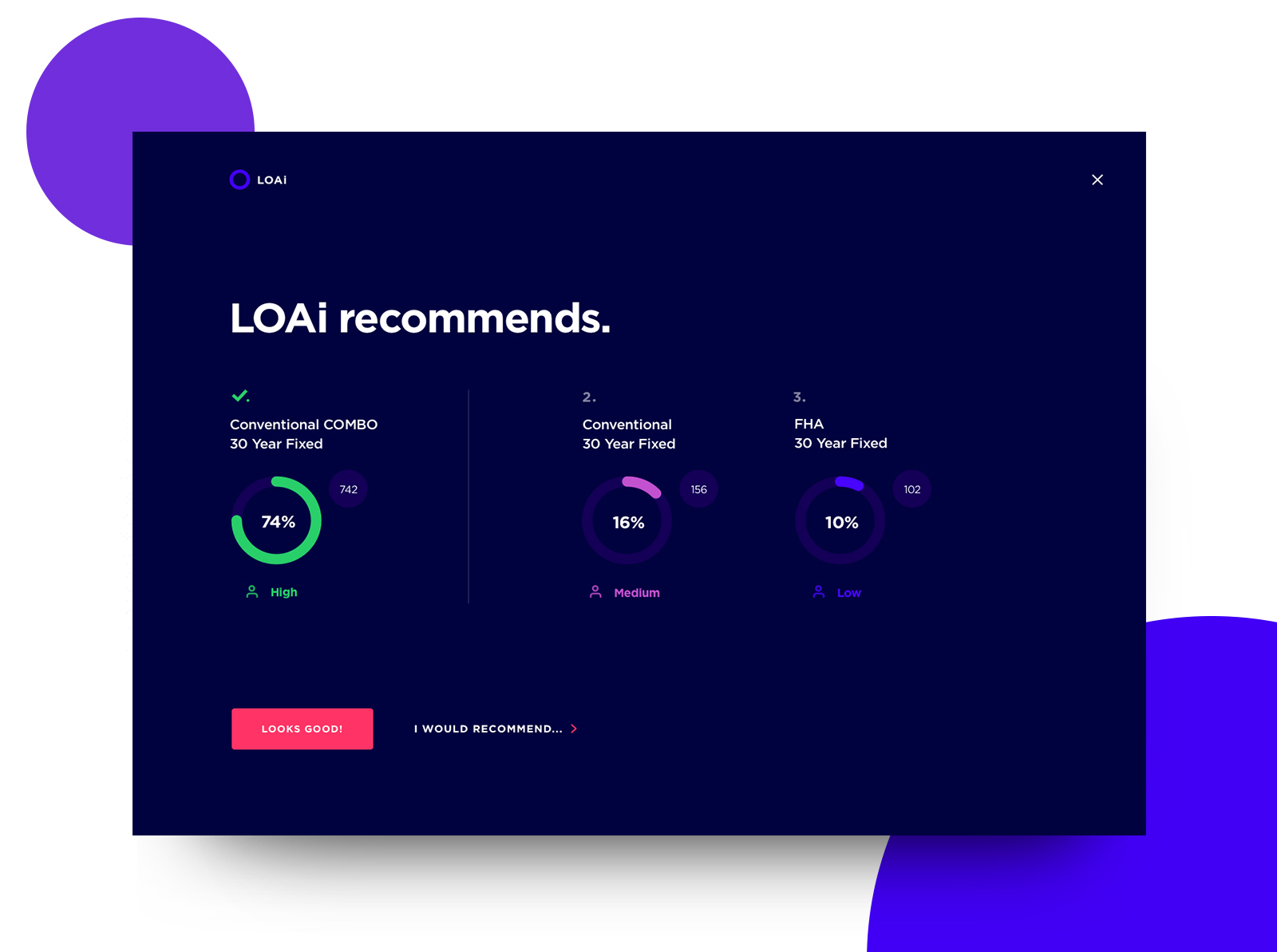

Lower’s platform will incorporate an internal, proprietary artificial intelligence technology dubbed LOAi, which will help in-house experts make mortgage recommendations. The platform will use AI to analyze thousands of data points and loan history to instantly generate its custom recommendation for each prospective borrower.

And while implementing AI may seem on trend with the latest industry marketing ploys, Lower.com CEO and founder Dan Snyder tells Inman that it’s merely a tool to help streamline the process. For example, the interface will not include bells and whistles upon launch, just a simple kickstart process to connect with an advisor.

Swanepoel Trends Report helping brokerages navigate rapid real estate industry change

The most thorough annual analysis of brokerage industry trends READ MORE

Swanepoel Trends Report helping brokerages navigate rapid real estate industry change

The most thorough annual analysis of brokerage industry trends READ MORE

“Our platform is not consumer facing, it’s an enhancement to our loan advisors to help them recommend products and services based on historical data or trends we’re seeing,” Snyder said.

Snyder, who’s worked for Wells Fargo and co-founded private mortgage lender Homeside Financial, realized there’s a need to appeal to the customer and manage expectations to deliver low rates. He also noted that often times in mortgage the experienced advisors’ perspectives are based on the amount of transactions they’ve done.

“But there are thousands of products out there. Our system is based on helping the originator narrow them down,” Snyder said. “This is coupled with a genuine goal to have the social aspect improved, including breathing life into underwriting engines and calculators that don’t tell you whether you should keep renting or buy now.”

Lower.com’s features will include lower service rates due to virtual loan officer assistants and a centralized location that reduces overhead, digital application tool PersonalApply to make applying easy and conversational, along with free refinancing for life and 24/7 support.

The company offers a mobile interface and the ability for borrowers to call, text, or email with questions or support requests.

“As time goes on, our system will continue to learn based on the closed loan data we see, which will help flesh out features further,” Snyder said.

Source: click here