Mortgage rates continued to drift sideways last week, waiting for clear signs that might push the Fedin one direction or the other. While the Fed’s statements indicate that the Fed’s focus is shifting towardthe labor market, inflation is something it can’t ignore. PCE data revealed the core consumer inflationhas ticked back upward on an annualized basis, which makes the case for the Fed to hold rates steady.On the other hand, consumer moods are darkening, and signs are beginning to flash that could presage a weakening in the labor market.

This week could change the odds of a rate cut from the Fed, pushing those odds in either direction.Weekly jobless claims, JOLTS, and the monthly employment data are all due. If these data pointsindicate a softening labor market, then rates could drift downward due to increased expectations of arate cut. However, with inflation still not hitting the Fed’s target, a labor market that doesn’t needmuch help could prompt the Fed to hold off on cutting rates this month and wait for its next meeting.

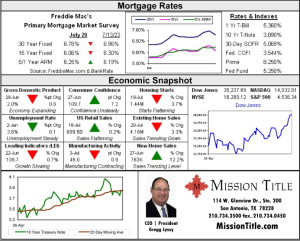

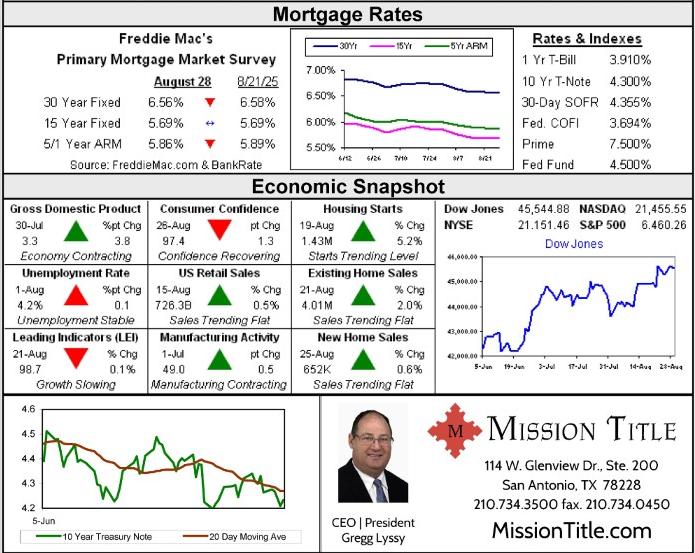

Mortgage Rates and Economic Snapshot

Mortgage Rates and Economic Snapshot