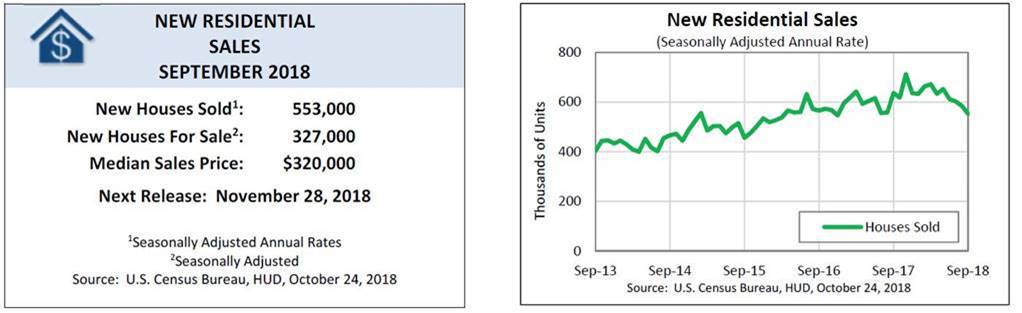

New residential home sales dropped 5.5 percent in September to a low unseen for nearly two years, according to a new residential sales report released Wednesday by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development (HUD).

Nationwide, new single-family home sales dropped to a seasonally adjusted rate of 553,000 units — a 13.2 percent year-over-year drop from September 2017. The average sales price was $377,200 while the median sales price was $320,000.

Such plunges come somewhat unexpectedly as August saw a home sales growth of 3.5 percent after two months of straight declines.

“Sales activity last month was impacted heavily by declines in the South and West, with Hurricane Florence likely driving the South’s numbers,” Joel Kan, MBA’S AVP of economic and industry forecasts, said in a statement.

“As far as the West is concerned, we have started to see some moderation in home price appreciation in recent months, and this is a further sign that certain markets may be starting to cool off because of affordability challenges.”

Courtesy of HUD

Regionally, year-over-year new-home sales are down 51.3 percent in the Northeast and 15.8 percent in the West. Still, home sales are up in some parts of the country — in September, they grew by 11.4 percent in the South and 4.1 percent in the Midwest.

How to guarantee success in Q4 (as the market changes)

Tom Ferry gets three Rockstar agents to reveal their best tips for Q4 2018 – and beyond! READ MORE

How to guarantee success in Q4 (as the market changes)

Tom Ferry gets three Rockstar agents to reveal their best tips for Q4 2018 – and beyond! READ MORE

Along with natural disasters, such numbers could also caused by increasing mortgage rates — the 30-year fixed mortgage rate has grown to an average of 4.85 percent, according to data from Freddie Mac.

“One thing is for certain, the economy cannot grow at a sustainable 3 percent pace for long if new home sales continue to tumble,” Chris Rupkey, chief financial economist at MUFG, told CNBC. “The Fed’s rising interest rates may be more harmful for economic growth than they thought, chiefly because of its effect on long-term interest rates and hence mortgage rates.”

Source: click here