The number of older Americans who are renting their homes, rather than owning them outright, has increased markedly over the last decade, driven in part by an overall aging population and the lingering effects of the foreclosure crisis, according to new research.

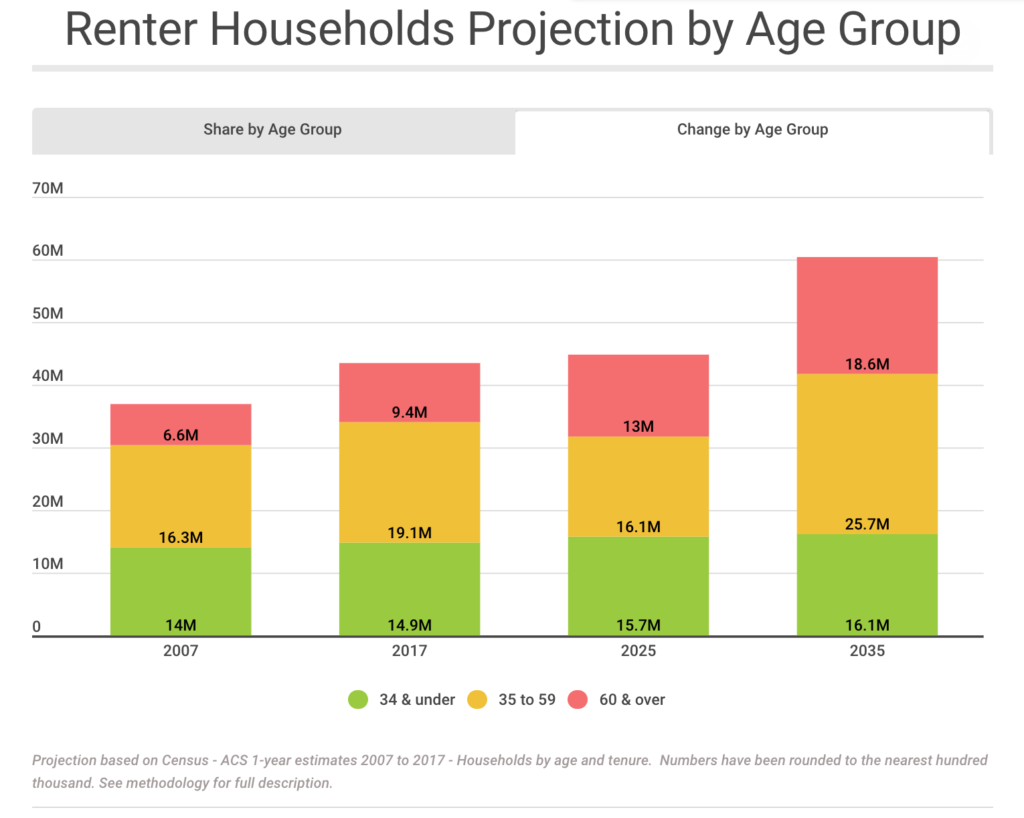

The research, unveiled this week by apartment search website RentCafé, shows that between 2007 and 2017, the number of renter households aged 60 and older jumped from 6.5 million to 9.4 million, or an increase of 43 percent.

Younger renters in their 20s and early 30s still rent in larger total numbers, coming in at nearly 15 million households. But that demographic saw only a 7 percent increase during that same period.

Renter households between the ages of 35 and 59 increased by 17 percent between 2007 and 2017, which is also significantly less than the increase among older Americans.

The increase in renter households also outpaced the growth of homeownership in every age range. Among older Americans, homeowner households grew by 31 percent between 2007 and 2017. All other age ranges saw declines in their homeownership rates during that time period.

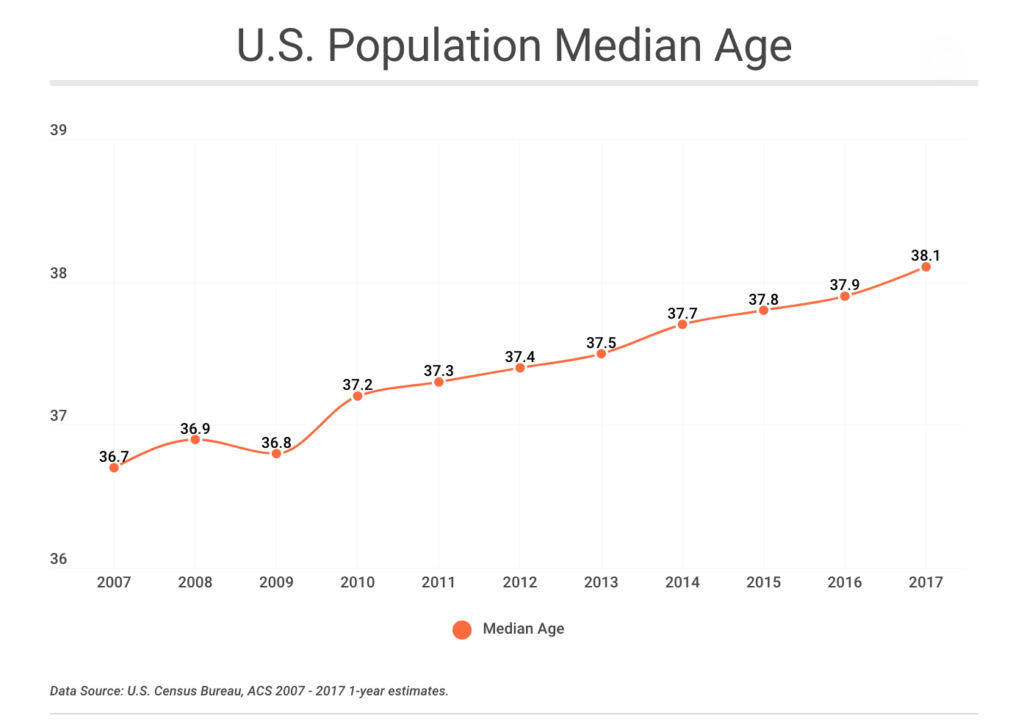

RentCafé’s research shows that one reason for increasing rates of renter households is because Americans are getting older — the median age in 2017 was 38.1, up from 36.7 a decade earlier — and because “the older population is no longer enthusiastic about homeownership, with many seniors starting to downsize and move into rentals.”

A company founded and built on human potential

The EXIT Realty Formula: how the power of the positive helped create a powerhouse brand READ MORE

A company founded and built on human potential

The EXIT Realty Formula: how the power of the positive helped create a powerhouse brand READ MORE

Credit: RentCafé

“As their children move out, they find themselves alone, in a big house that costs a lot to maintain, causing them to rethink their housing choices,” RentCafé reports.

Recent research from Harvard also notes households earning less than $30,000 a year have driven the growth among older renters.

“This increase likely reflects the aging of existing low-income renters into their 50s, as well as the shift of many financially strapped older households from owning to renting after the foreclosure crisis,” the report from Harvard’s Joint Center for Housing Studies states.

RentCafé found that the cities with the largest increases in older renters mostly lie along the so-called “Sun Belt.” Austin led the pack, with an increase of 113 percent from 2007 to 2017. Phoenix, Arizona, Fort Worth, Texas, Jacksonville, Florida, and Charlotte, North Carolina, rounded out the top five.

The trend toward more older Americans renting should also continue, according to RentCafé. By 2025, the number of renter households aged 60 and older is projected to grow to 13 million and by 2035 it should it 18.6 million — or nearly double what it was in 2017.

Credit: RentCafé

Renter households among younger groups, on the other hand, are expected to see much more modest growth, the research shows.

Though the RentCafé report doesn’t go into detail about what these shifts will mean for the broader economy, it does state that “this growing share of older Americans is bound to have an impact on the U.S. real estate market.

“This is a cohort of people that witnessed firsthand the impact of the 2007 housing crisis and the re-shaping of the economy, forcing most of them to give up their homeowner status and move into rental apartments,” the report explains. “It’s important for developers to acknowledge the particular housing needs of older renters and make sure that they are being met.”

Source: click here