The state of the housing market isn’t defined by any single factor but rather an array of interlocking variables. When the disparate parts are put together, what’s the bigger picture? That’s what Department of Housing and Urban Development’s (HUD) Office of Policy Development and Research reveals in its quarterly National Housing Market Summary.

For the first quarter of 2016, HUD concluded that as supply, demand, sales and affordability stabilize, the housing market is improving as a whole. However, the homeownership rate has dipped all the way down to 1985 levels as ripple effects of the housing crisis linger.

@HUDgov: The housing market continues to improve as a whole. SupplyNew construction starts for single-family homes rose 23 percent since last year for a total of 791,000 units in Q1 — their highest level since the final quarter of 2007. However, multifamily housing starts fell 7 percent from Q4 to 343,000 units, a number that’s still up 3 percent from one year ago.

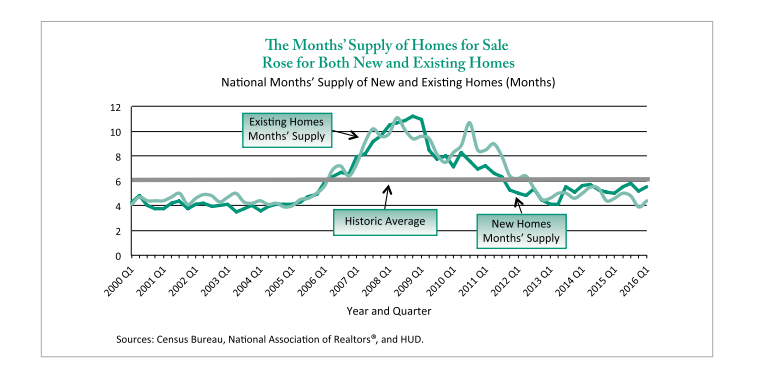

New starts for single-family homes rose 23 percent in a year.Despite low inventory woes, HUD noted a first-quarter increase in months’ supply of homes (a measurement that divides the total number of homes for sale over the number of homes sold in one month).

The 244,000 new units in Q1 would support 5.5 months of sales, up from 5.0 months since last year. In the first quarter, there were also 2.0 million existing homes for sale, a 4.4-month supply. This is up from 3.9 months in Q4, but down slightly from a year ago (4.6 months).

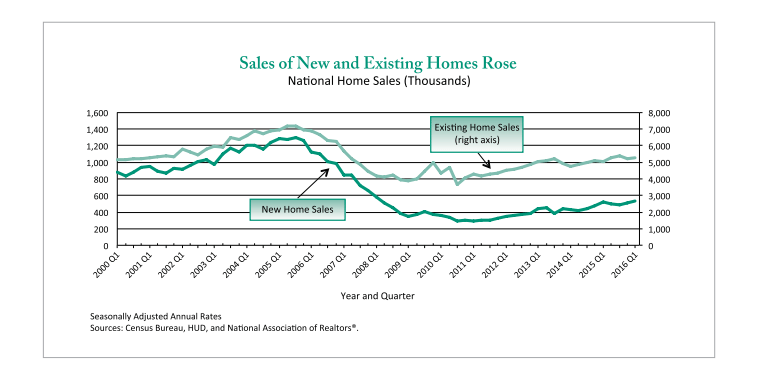

Demand and affordabilityNew and existing home sales both rose in the first quarter. New single-family home purchases grew 2 percent from a year prior and 5 percent from Q4. Existing home sales increased 5 percent year-over-year, and 2 percent from the previous quarter.

Home prices experienced their 19th consecutive quarter of increases but at a slightly slower pace, appreciating at 1.3 percent quarter-over-quarter and 5.7 percent year-over-year.

In addition, “declining mortgage interest rates, falling median house prices, and increasing Median Family Income have combined to improve affordability in the past two quarters,” the report noted.

The NAR Composite Housing Affordability Index registered at 171.4 in the first quarter, up from 165.5 in the previous quarter.

FinancingHomeowner equity continues to gain strength while foreclosures become increasingly rare.

Foreclosure starts (defined as default notices or scheduled foreclosure auctions, depending on the state) are down 15 percent from one year ago, according to RealtyTrac, while CoreLogic reported that equity grew by almost $1.2 trillion over the course of 2015. Moreover, during 2015, the number of underwater borrowers dropped by 1 million.

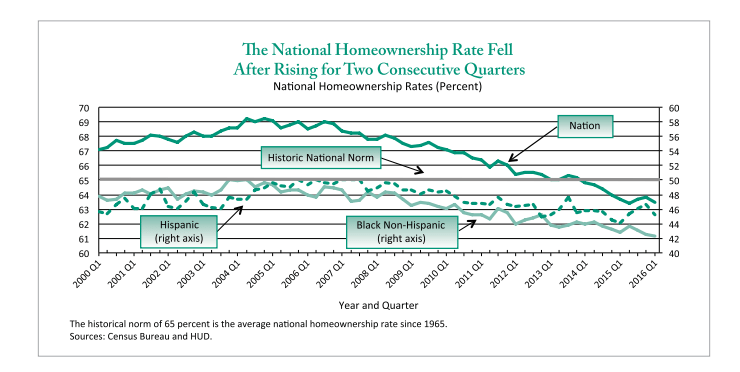

Homeownership rateThe homeownership rate of 63.5 percent reached its lowest level since the final quarter of 1985 (save for Q2 2015). After gaining ground for two quarters in a row, the homeownership rate lost 0.3 percentage points at the start of this year.

The homeownership rate is down to 1985 levels.

“Compared with the early 2000s, the current relatively low homeownership rates reflect the aftermath of the subprime lending crisis and the high rates of unemployment and underemployment as a result of the severe 2007–2009 recession,” the report noted.

“More recently, flat income growth and restrictive credit markets have affected homeownership.”

Like me on Facebook! | Follow me on Twitter!

Source: click here