Investors are not pleased after Realogy on Thursday released its first quarter 2019 earnings, in which the New Jersey-based residential real estate holdings giant reported a second consecutive quarter of losses.

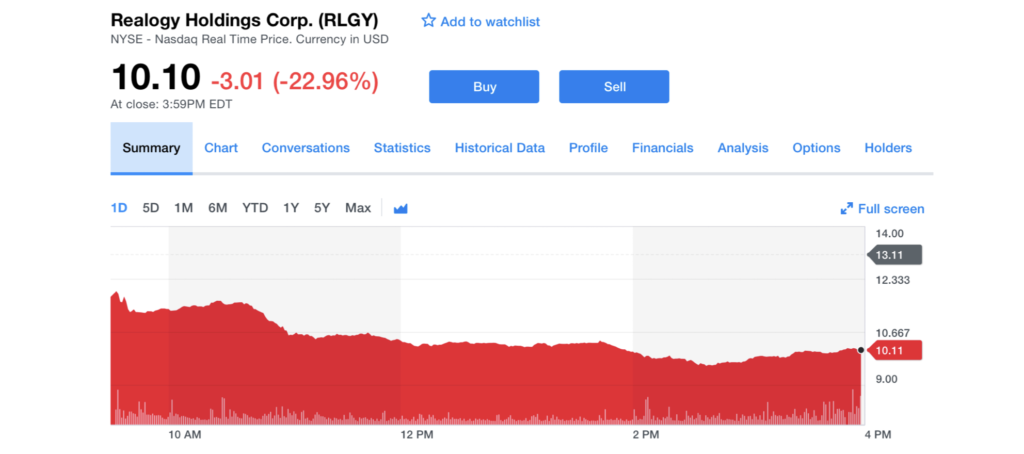

Realogy’s stock price on the New York Stock Exchange (NYSE) plummeted more than 22 percent to a new all-time low of $10.10 per share at closing on Thursday, exceeding the previous all-time low of $14.32 per share after the corporation’s Q4 2018 earnings call in February.

Overall, the company’s stock is down 59.3 percent over the last year, according to data from MarketWatch.

Realogy’s revenue in the first quarter of 2019 fell 9 percent to $1.1 billion, resulting in an adjusted net loss per share of $0.67 – compared to the previous quarter’s adjusted net loss per share of $0.38.

Realogy’s stock price at closing (4 p.m. EST).

Realogy is the largest residential real estate company in America, and owns NRT, the nation’s largest brokerage by sales volume, as well as the notable franchise brands Better Homes and Gardens Real Estate, Coldwell Banker, Corcoran, Century 21, Sotheby’s International Realty, ERA, Citi Habitats, Climb Real Estate and ZipRealty.

“Focus on what you love to do.”

The YourWayHome team shares how they do the heavy lifting and let Realtors do what they do best READ MORE

“Focus on what you love to do.”

The YourWayHome team shares how they do the heavy lifting and let Realtors do what they do best READ MORE

Realogy CEO and President Ryan Schneider said the losses were primarily due to weakened transaction volume at NRT.

The company’s revenue shrunk from $917 million in Q1 2018 to $816 million in Q1 2019 — a $101 million dollar loss.

“Realogy’s Q1 operating [earnings before interest, tax, depreciation and amortization] was negative $4 million in what was another tough quarter for the housing market,” Realogy CEO and President Ryan Schneider said on the earnings call. “A 9 percent transaction volume decline drove our revenue decline in the quarter.”

Schneider said the first quarter of the year is seasonally the company’s smallest quarter, and despite recent struggles, he’s confident in Realogy’s ability to improve its proposition value to agents and consumers alike.

“Despite continued market headwinds and an increasingly competitive environment, we remain intensely focused on executing our strategy and improving our value proposition to drive greater success for our affiliated agents, our franchisees and, ultimately, our shareholders.”

Investment research firm Zacks currently has Realogy stock rated as a, “strong sell,” expecting only a 2.19 percent annualized return over the next 1-3 months.

A Realogy spokesperson declined to comment on stock activity on Thursday.

Developing…

Source: click here