After hitting a 20-year low, home delinquency rates across the country are holding steady.

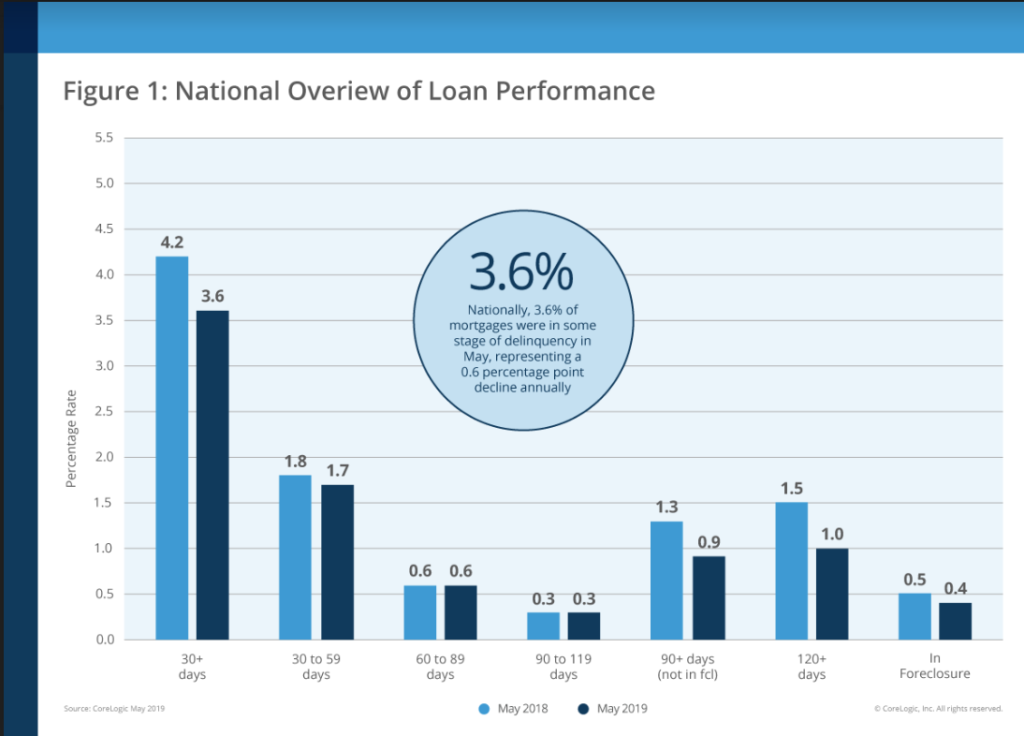

According to CoreLogic data released Monday, 3.6 percent of homeowners fell into some sort of delinquency on their mortgages in May — the same number as in April but down from 4 percent in March. Foreclosure rates, in which a home is seized by the government due to inability to pay the mortgage, are at 0.4 percent, also unchanged since April.

Taken together, delinquency and foreclosure rates have been falling steadily since 1999. Delinquency rates were 4.2 percent in May 2018 while foreclosure rates were 0.5 percent. No state has seen a gain in its foreclosure rates this month.

CoreLogic

“Growth in family income and home prices continues to support low delinquency rates,” said Dr. Frank Nothaft, chief economist at CoreLogic, in a prepared statement. “Communities that experienced a rise in delinquencies are generally those that also suffered from natural disasters.”

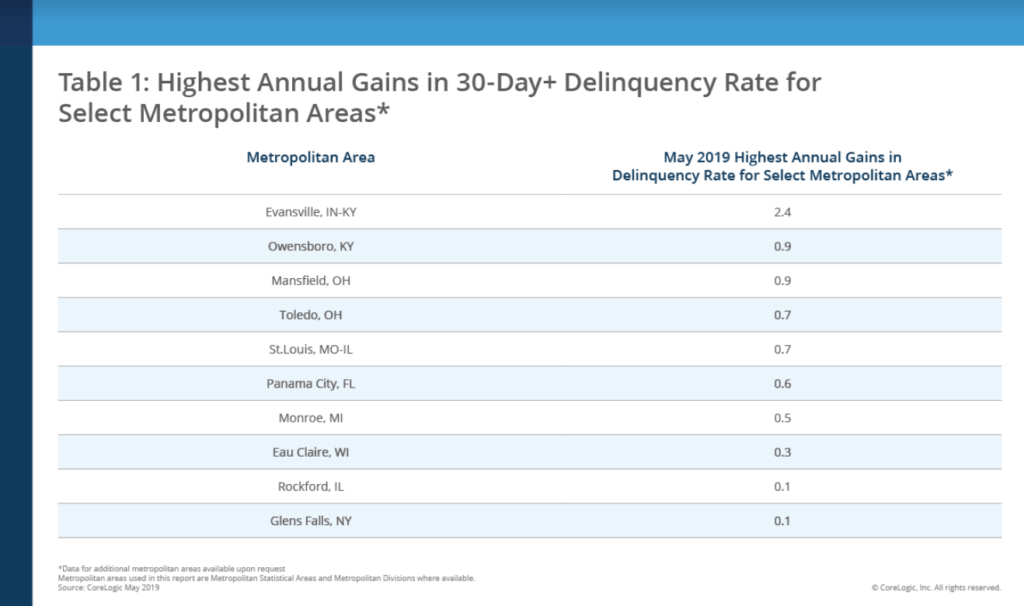

Indeed, areas hit by natural disasters were more likely to fall into delinquency. Hurricane Michael, the California wildfires and recent flooding in Nebraska have all played a role in higher-than-average delinquency rates in some part of these states.

‘The smartest tech choice I made this year.’

12 real estate leaders share the decisions that helped shape their businesses READ MORE

‘The smartest tech choice I made this year.’

12 real estate leaders share the decisions that helped shape their businesses READ MORE

Areas hit by floods, such as Evansville and Owensboro in Kentucky, experienced the highest jumps in delinquency rates from last year — at 2.4 percent and 0.9 percent, respectively.

CoreLogic

“While the rest of the country experienced record-low mortgage delinquency rates again in May, the Midwest and parts of the Southeast are still experiencing higher rates as they recover from extreme weather,” said Frank Martell, president and CEO of CoreLogic. “Areas in Kentucky and Ohio, which were hit particularly hard this spring with historic flooding, experienced some of the largest annual gains in the country.”

Such numbers indicate that delinquency and foreclosure rates are continuing to fall and stabilize in no small part due to a strong job market and low unemployment rates. Nonetheless, natural disasters such as fires and floods can also upend stability, particularly in regions that have lower home values and incomes.

Source: click here