EasyKnock, a home sales/leaseback company that allows homeowners to release the equity on their home, has closed $215 million in Series A debt-equity funding according to an announcement on Thursday.

Existing investor Blumberg Capital led the funding round, which included contributions from Montage Ventures, Kairos, FJ Labs, 500 Startups, Correlation Ventures, and Rubicon Ventures. The Series A funding round comes on the heels of a $103.5 million seed funding round in Sept. 2018, and will go toward the expansion of the EasyKnock’s team, market availability, and technology.

Most importantly, the $215 million will assist in the launch of MoveAbility, a new program that enables homeowners to sell their property to EasyKnock and stay in the home as renters during their search for a new home to buy and own.

“We are continuing to innovate in home ownership and flexibility,” said EasyKnock CEO Jarred Kessler in a prepared statement. “With MoveAbility, we’re offering people a bridge between their current home and their future home, which is something millions of Americans need.”

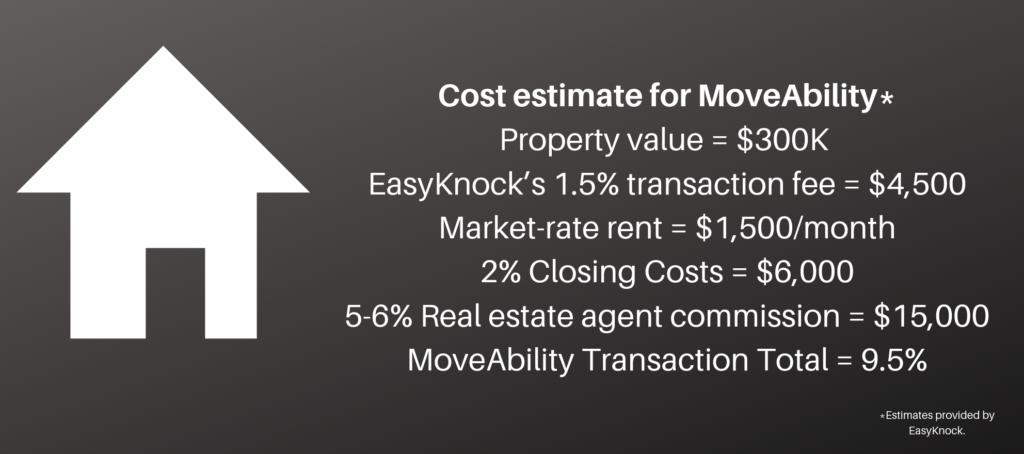

EasyKnock will provide a purchase offer within 24 hours of applying, which includes a 70 percent upfront equity cash-out, a market-rate monthly rent, a 1.5 percent transaction fee, and a 2 percent closing fee. If a homeowner decides to use a real estate agent, they’ll also have to pay a 5-6 percent real commission.

In the end, EasyKnock says homeowners will pay anywhere from 3.5 to 9.5 percent of their home’s value for the cost of selling and leasing back.

Home. Awesomeness. Ingenuity. Excellence. Here’s what they mean to us.

The best wear blue and know that these four ingredients add up to a powerful story READ MORE

Home. Awesomeness. Ingenuity. Excellence. Here’s what they mean to us.

The best wear blue and know that these four ingredients add up to a powerful story READ MORE

EasyKnock will pay off the mortgage and after a two-week closing time, homeowners will receive their equity cash out. From there, can stay in their current home as renters anywhere from three to 18 months (a year and a half) as they search for a new home.

Lastly, once homeowners move into their new home, they’ll be able to sell the previous home on the open market. EasyKnock says they’ll give homeowners the remainder of the home equity plus any appreciation in home value.

“It’s difficult to get a new mortgage until you have paid your current mortgage. This keeps many homeowners in a state of limbo,” he added. “MoveAbility allows homeowners to pay their mortgages off without having to uproot the family, and without having to settle for a lower price.”

MoveAbility will be available in Texas, Florida, Georgia, Kanas, Michigan, Arizona, Indiana and Ohio — the same markets as Sell & Stay, EasyKnock’s home equity line of credit (HELOC) leaseback program that enables homeowners to cash out their home’s equity and stay in the property as renters for up to three years.

Homeowners are able to put those funds towards home improvements, debt payoff, or other financial obligations. After three years, homeowners can buy the home back or permanently move out and receive the remaining equity.

The funding round will also aid in Sell & Stay’s expansion to Colorado and Virginia.

Source: click here