House prices are about to skyrocket — again.

Following an all-time high over the winter of $285,700, housing prices shot up in May by 7.1 percent year-over-year, the largest spike in four years, according to the CoreLogic Home Price Index and Forecast, released on Wednesday.

The eye-opening increase in May reversed some moderate annual reductions brought on by rising mortgage rates, but prices are expected to continue their rise despite the hikes — up another 5.1 percent by 2019, according to CoreLogic.

“The lean supply of homes for sale is leading to higher sales prices and fewer days on market, and the supply shortage is more acute for entry-level homes,” said Dr. Frank Nothaft, chief economist for CoreLogic, in a statement. “During the first quarter, we found that about 50 percent of all existing homeowners had a mortgage rate of 3.75 percent or less.”

Photo Credit: CoreLogic

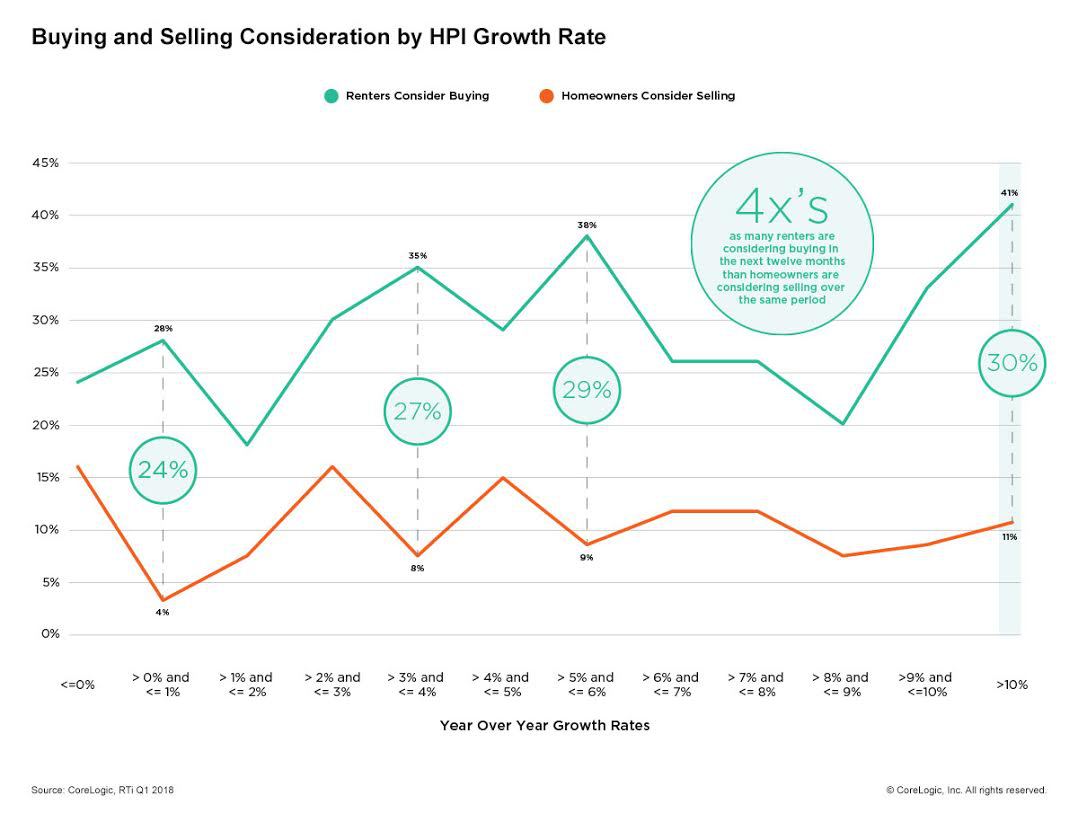

Home prices, which have been growing steadily for the past 72 months, indicate an ongoing trend, and a housing market that faces declining inventory among high demand. Moreover, the analysis found that, in 2018, 15 percent of homeowners and 28 percent of renters wanted to buy a property while only 11 percent of those with properties wanted to sell.

Real estate blockchain and cryptocurrency explained

The key concepts and applications you need to know READ MORE

Real estate blockchain and cryptocurrency explained

The key concepts and applications you need to know READ MORE

Photo Credit: CoreLogic

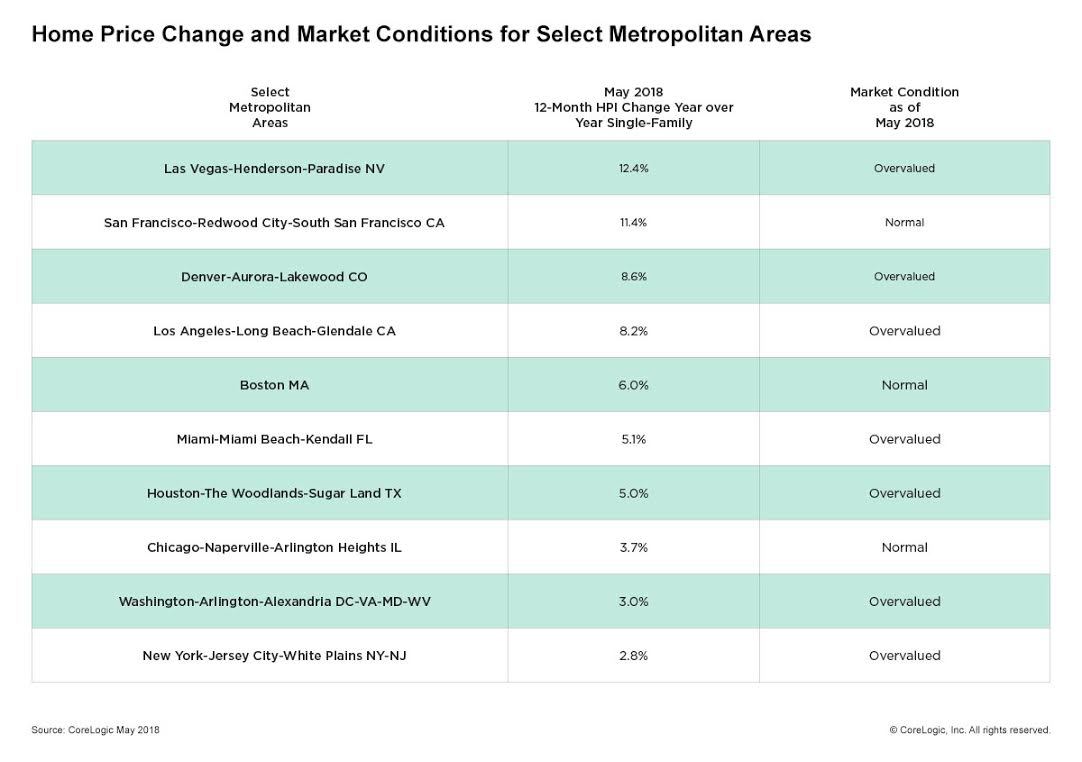

Naturally, some parts of the country experienced an even more dramatic growth in prices. Las Vegas, San Francisco, Denver and Los Angeles continue to costs of housing disproportionate with local income.

“The CoreLogic consumer research demonstrates that, despite high home prices, renters want to get out of their rental property and purchase a home,” said Frank Martell, president and CEO of CoreLogic. “Even in the most expensive markets, we found four times as many renters looking to buy than homeowners willing to sell.”

CoreLogic also found surprising trends in other pockets of the country. Washington, Nevada, Idaho and Utah all saw prices grow by more than 10 percent since May 2017.

Additionally, out of 100 major cities in the U.S., 40 markets were overvalued or had prices that were not sustainable compared to local income and population, according to the index.

“Until more supply becomes available, we will continue to see soaring prices in cities such as Denver, San Francisco and Seattle,” Martell added.

Source: click here