Mortgage rates held relatively steady last week as most economic news came in better than expected.Consumer Confidence bounced back upward by 6.9 points to the highest level it has seen since spring.The third quarter’s GDP was once again adjusted upward for a final 3.2% reading. The core reading ofthe PCE Prices came in at 0.2%, providing more hope that some inflationary pressures are finallystarting to diminish. As has been the case ever since the Fed began waging war on inflation, thehousing market is taking the brunt of the battle. Existing Home Sales sunk another 7.7%. While NewHome Sales beat expectations and registered a 5.8% increase, sales are still 15.3% lower than one yearago. Existing Home Sales are now down 37% since the start of 2022.

As we enter the last week of 2022, mortgage rates appear poised to remain mostly steady in the hopesthat next year will bring more good news in the battle against inflation. However, with traders onvacation and a holiday-shortened week, volatility could spike at any unexpected news or data.

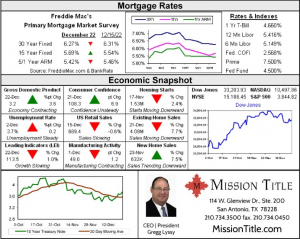

Mortgage Rates and Economic Snapshot

Mortgage Rates and Economic Snapshot