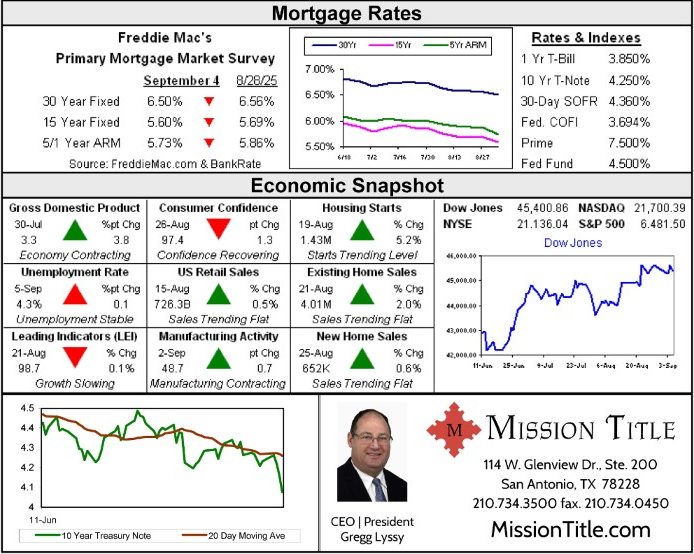

After last week’s marginal employment data, the market is entirely pricing in a rate cut from the Fed atits next meeting. Despite the President’s recent firing of the head of the Bureau of Labor Statistics(BLS), the outlook for the labor market continued to dim. Last month, only 22,000 new jobs werecreated, below the expectations of 75,000. And while July saw 6,000 jobs added to its tally, June wasadjusted to a loss of 13,000 positions, the first monthly loss since December 2020. The number of jobopenings also dipped near pandemic levels, while both weekly and continuing jobless claims notchedslightly higher. While the ISM indexes managed to increase, mortgage rates slipped downward.

This week will be focused on inflation and jobs. Both the CPI and PPI are due and are expected topush their annual readings upward. The annual benchmark revision to the BLS data is also due. If wesee a repeat of last year, where 818,000 jobs were removed from previous tallies, then mortgage ratesare very likely to slip further downward, but the high inflation numbers could temper their slide.

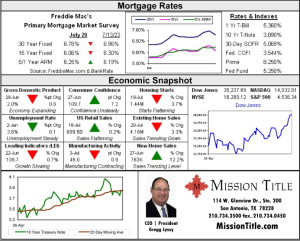

Mortgage Rates and Economic Snapshot

Mortgage Rates and Economic Snapshot