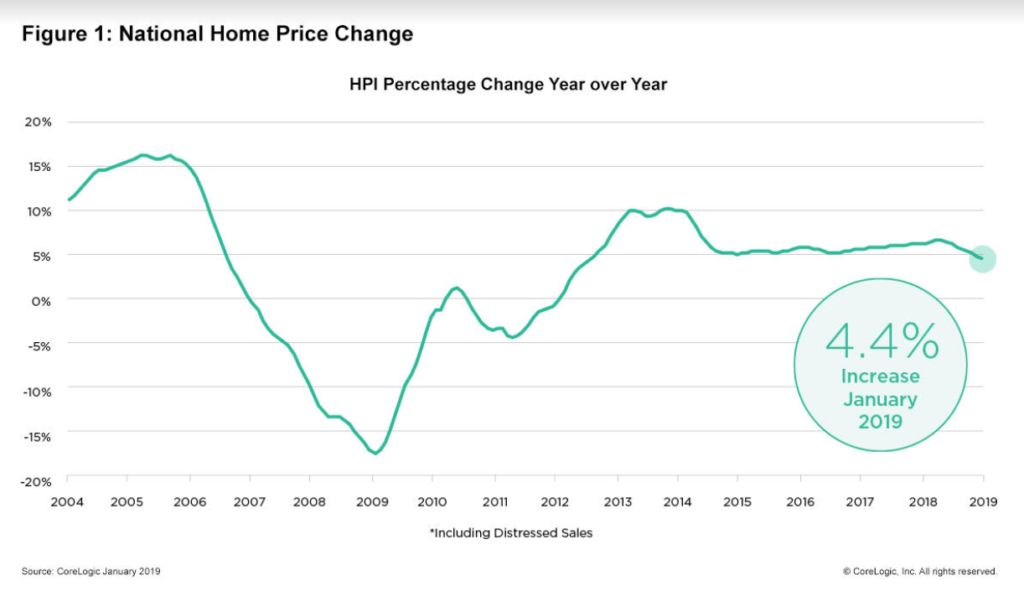

In January, home prices grew by the smallest rate since 2012, increasing by a mere 4.4 percent year-over-year and just 0.1 percent over the first month of 2019, according to new data from CoreLogic released Tuesday.

Since 2012, home values have increased steadily, giving many homeowners confidence that their equity would continue to grow unabated. Recent market trends, however, point toward a turnaround. After peaking at 6.6 percent in April, growth has been slowing steadily since then.

“The spike in mortgage interest rates last fall chilled buyer activity and led to a slowdown in home sales and price growth,” said CoreLogic Chief Economist Dr. Frank Nothaft in a prepared statement. “With interest rates at this level, we expect a solid home-buying season this spring.”

Courtesy of CoreLogic.

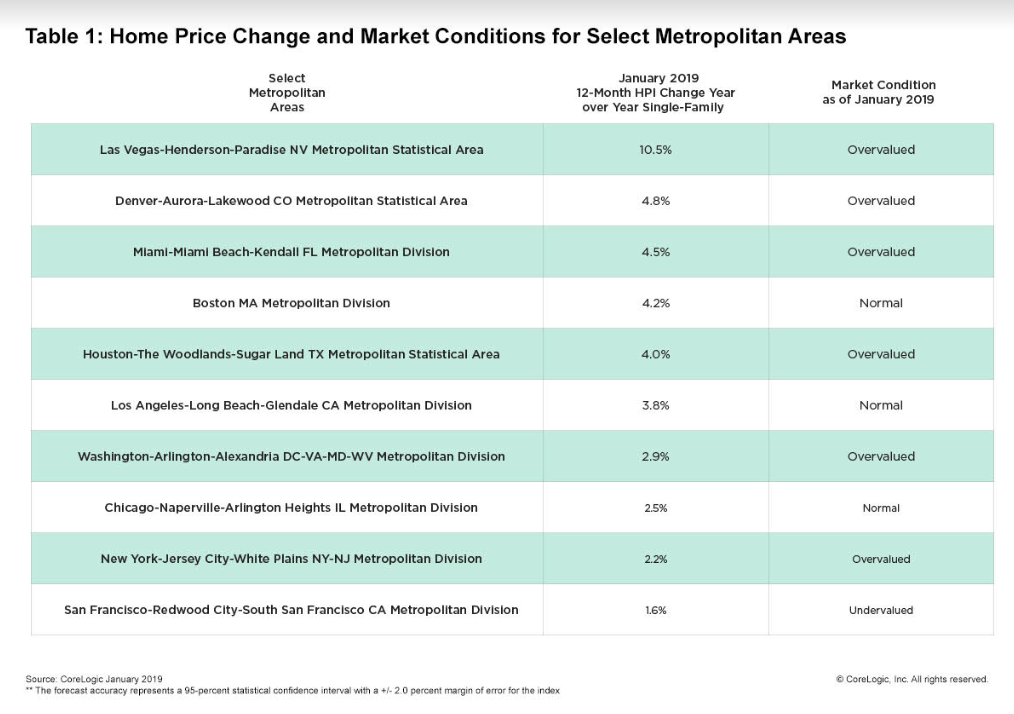

While states including Washington and Colorado have previously seen double-digit growth, only Idaho and Nevada have experienced home value escalations by more than 10 percent. In Louisiana and North Dakota, home values fell by 0.8 percent and 0.7 percent, respectively.

The slowdown is the result of increasing unaffordability, according to CoreLogic. As home values and mortgage rates rise, some people are delaying decisions to buy property in the hope of better rates.

The best advice I’ve ever received about luxury customer service

Five top producers on the guidance that set them up for success READ MORE

The best advice I’ve ever received about luxury customer service

Five top producers on the guidance that set them up for success READ MORE

Courtesy of CoreLogic.

Experts, however, believe the turnaround may not offer the kind of relief many are hoping for – any drop in home values will be modest and not significant enough to offset stagnating incomes, according to CoreLogic.

“The slowing growth in home prices was inevitable in many respects as buyers pull back in the face of higher borrowing and ownership costs,” CoreLogic President Frank Martell said a prepared statement. “As we head into 2019, we can expect continued strong employment growth and rising incomes which could support a re-acceleration in home-price appreciation later this year.”

Source: click here