Transparency is the cornerstone of any successful, trustworthy business. But not all real estate tech companies practice transparency; the most egregious example occurs in fundraising.

The lines between raising equity and securing debt have been blurred, and numbers are being inflated in an effort to mislead the public. If a business model relies on deception, it’s a bad business model.

Equity vs. debtA company raises equity and secures debt.

When a company raises equity funding, it sells investors stock in exchange for capital; investors are buying part of the company at an agreed-upon valuation.

When a company secures debt, it is granted a line of credit to access funds when needed, or is given a loan — both of which need to be paid back with interest.

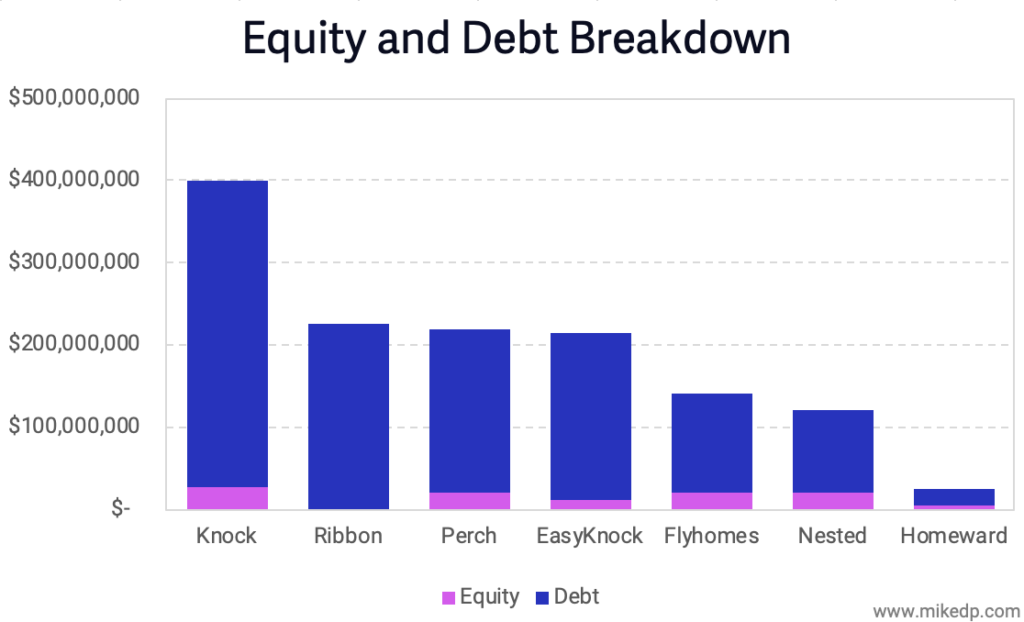

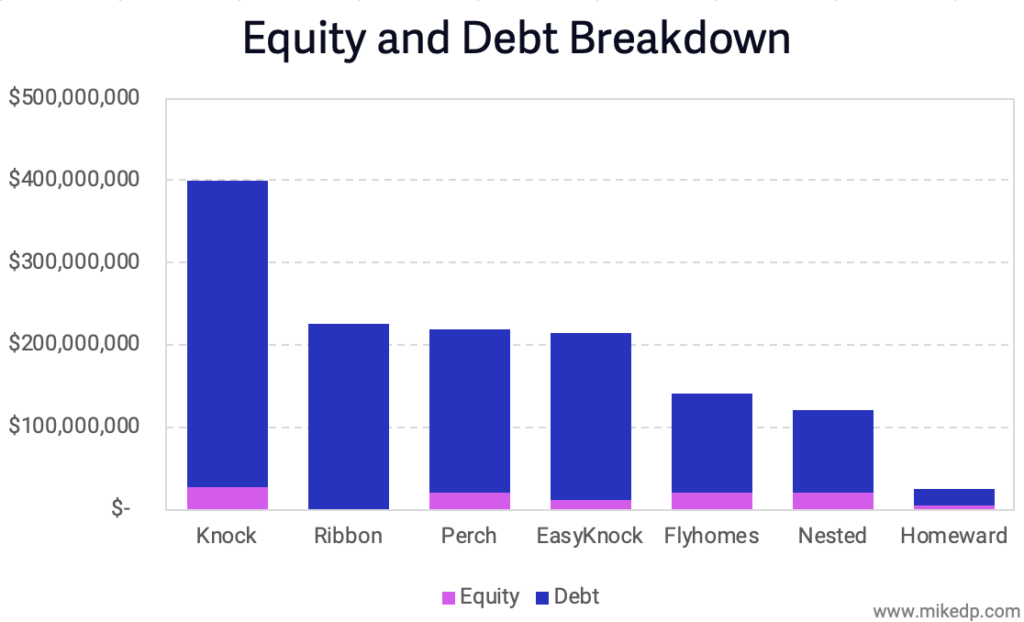

With the rise of iBuyers and similar models that involve a strong financial component, such as purchasing homes directly from homeowners, debt requirements are skyrocketing. Many real estate tech companies, some of which are barely a year old, are securing hundreds of millions of dollars in debt.

Debt is not equityAs far back as I can recall, when a company announced that it had raised money, it was talking about equity investment. An investor had reviewed the business pitch, decided the model and the team were winners, and invested money into the venture in exchange for stock.

At some point, things changed. When raising money, it is becoming increasingly common for real estate tech companies to combine equity and debt together into a larger, more impressive sounding number.

Because companies are using debt to finance the purchase of homes, the amounts are absurdly large. In fact, the companies that combine equity and debt are, on average, artificially inflating the amounts raised by 11 times!

This is a deceptive practice meant to trick the public into thinking a company has raised more money than it actually has, and is bigger and more successful than someone might otherwise think.

Debt is not equity. If I get a $500,000 mortgage to purchase a new home, have I “raised $500,000 to reinvent the homebuying process for my family,” or have I simply secured a loan (which must be repaid)?

Best (and worst) practicesSome companies unapologetically combine equity and debt numbers and refuse to reveal the breakdown. Others combine equity and debt as a headline number, but eventually reveal the breakdown later in a press release.

Artificially inflating the headline number is still deceptive, but at least they’re not brazenly hiding the truth.

The best practice — and the most transparent — is talking about equity as equity, debt as debt, and not inflating the headline number by combining the two.

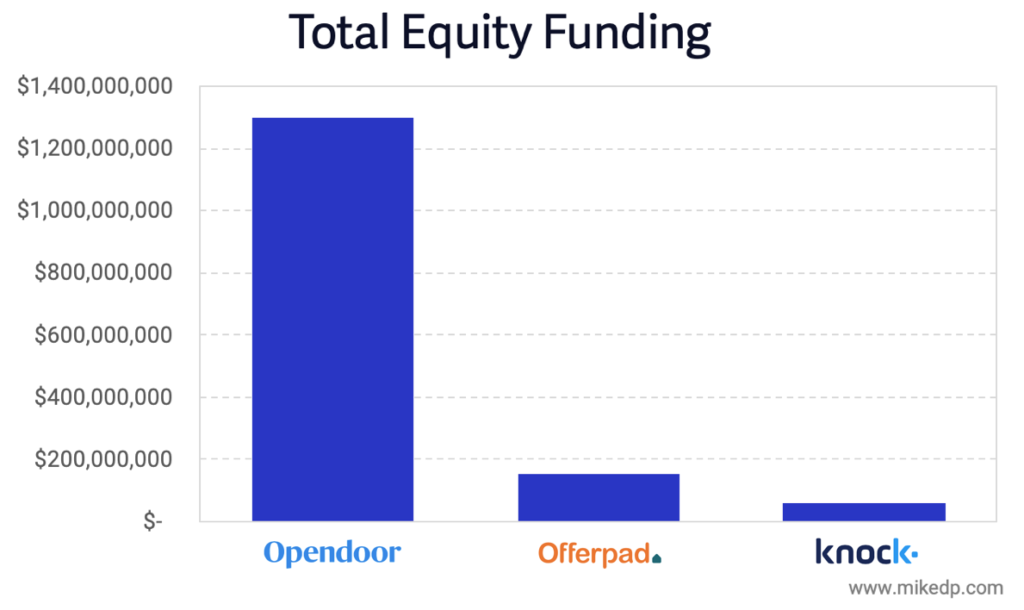

Transparency in actionFull credit to the two biggest iBuyers, Opendoor and Zillow, for providing full transparency around capital raises. As a public company, Zillow really has no choice other than to play by the rules.

Opendoor, as a private company, is not forced to offer the same level of disclosure, but nonetheless it chooses to in a commendable effort of transparency.

Ribbon and Knock are two of the worst offenders, with the following big-money, attention-grabbing headlines: “One-year-old Ribbon raises $225M to remove the biggest stress of home buying,” and “Knock Raises $400M To Simplify Home Buying.”

Unfortunately, each raise includes massive amounts of debt and neither company reveals the actual numbers (in Knock’s case, public filings later revealed the equity component was $26 million).

EasyKnock, Nested, Flyhomes, Homeward and Perch are all guilty of combining equity and debt into large headline numbers, and then go on to clarify the figures in the body of the announcement — but the damage has already been done.

Offerpad used to break out equity and debt, but is now combining both into a large, headline figure and not providing the details.

Like the others, the results are impressive headlines that confuse and mislead the public — especially when compared against peers, like Opendoor, that aren’t inflating their numbers.

Comparing apples and orangesThe issue becomes clear when making comparisons — often while someone is attempting to make a decision. Whether it’s a prospective customer, a potential employee or a curious journalist, misleading headlines create unfair and inaccurate comparisons.

For instance, if one compares the headline numbers from Opendoor’s $300 million raise with Knock’s $400 million raise, Knock might appear to be the fundraising winner.

However, in reality, Opendoor raised over 10 times the amount of equity than Knock: $300 million versus $26 million! And in total, Opendoor is even further ahead.

I imagine a number of companies — many of them run by friends and colleagues — undertake this practice to appear larger than they actually are.

But I also imagine that in real estate, a factor even more important than fundraising prowess is trust. And trust comes through transparency. If your business model relies on deception, it’s a bad business model.

Mike DelPrete is a strategic adviser and global expert in real estate tech. Connect with him on LinkedIn.

Source: click here