Platforms: Browser, mobile-responsiveIdeal for: Leasing agents and tenants

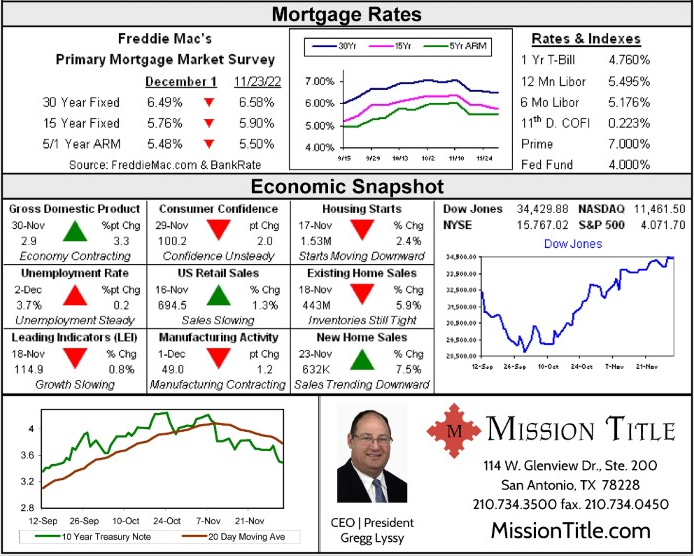

Mortgage rates managed to decline slightly last week as hopes grew for a smaller rate increase of 50basis points from the Fed at its next meeting. PCE Prices, which are the Fed’s preferred measure forinflation, revealed a core increase of only 0.2%. Consumer Confidence also slid lower, and the ISMManufacturing Index fell to 49.0%, indicating that US manufacturing is beginning to contract. Aspeech by Fed Chair Powell also seemed to hint that the Fed might increase by a smaller amount.While all these data points may indicate that the Fed could temper its fight against inflation, theannualized core PCE reading stands at 5.0%, far above the Fed’s target of 2.0%. The addition ofanother 263,000 jobs last month with the unemployment rate remaining steady adds to the pressure forthe Fed to continue with another 75 basis point increase at its meeting next week.

This week is likely to start with rates holding level. If the ISM Services Index drops more thanexpected, rates may start moving downward, but until next week rates won’t move all that much.