Pending home sales, or the period after a contract has been signed but before the sale has closed, dropped in October after a modest rise the previous month, according to data released Thursday by the National Association of Realtors.

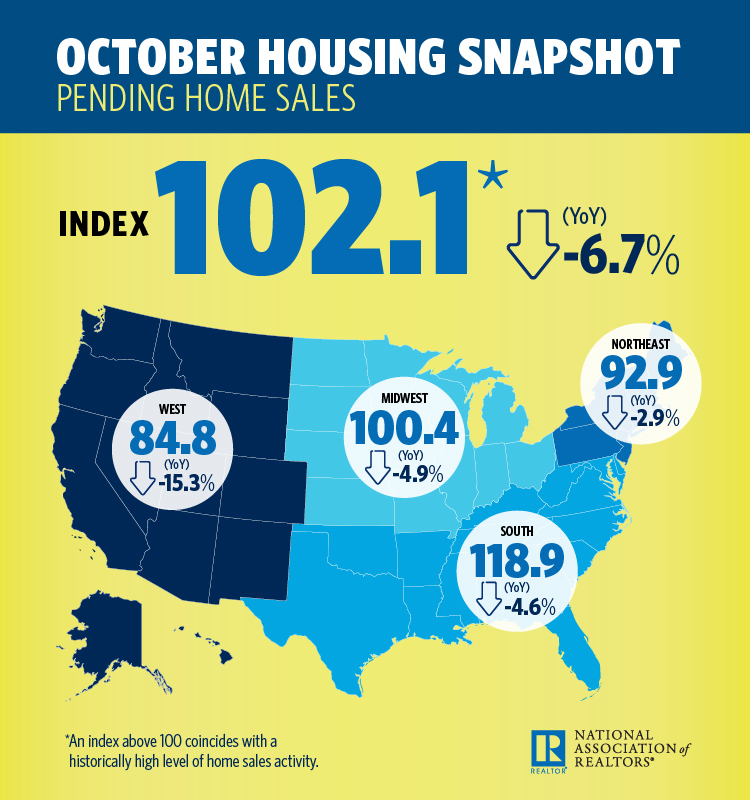

Overall, the Pending Home Sales Index fell 2.6 percent to 102.1 in October after rising by a modest 0.5 percent to 104.6 in September. Prior to that, pending home sales have fallen for eight months straight. Year-over-year, the downward trend has been unbroken — contract signings dropped 6.7 percent when compared to October 2017.

Courtesy of NAR

NAR’s Chief Economist Lawrence Yun said high mortgage rates – they rose to a seven-year high at 4.72 percent in September — could be to blame from the drop in sales.

“The recent rise in mortgage rates have reduced the pool of eligible homebuyers, Yun said. “But this time, interests rates are not going down, in fact, they are probably going to increase even further.”

Regionally, only the Northeast saw a modest 0.7 percent rise in pending home sales. In the Midwest, they fell by 1.8 percent while also dropping by 1.1 percent in the South and by 8.9 percent in the West.

The questions you’re not asking your tech vendor

Protect your brokerage before you make a purchase READ MORE

The questions you’re not asking your tech vendor

Protect your brokerage before you make a purchase READ MORE

“Yesterday’s new homes sales data showed a continued decline in new home sales and greater availability of new home inventory even as completed new homes sell quickly,” Danielle Hale, chief economist for Realtor.com, said in a statement. “Today’s pending home sales data reinforce that trend, pointing to continued softness in home sales ahead. With inventory starting to make a comeback in some markets, affordability seems to be emerging as the strongest factor holding back sales.”

But despite such an outlook, Yun said pending home sales will almost certainly start to rise on the long term – even if they fluctuate in the coming months.

“However, mortgage rates are much lower today compared to earlier this century, when mortgage rates averaged 8 percent. Additionally, there are more jobs today than there were two decades ago,” Yun said. “So, while the long-term prospects look solid, we just have to get through this short-term period of uncertainty.”

Source: click here